Implementation of "Pricing the Term Structure with Linear Regressions" from Adrian, Crump and Moench (2013).

The NominalACM class prices the time series and cross-section of the term

structure of interest rates using a three-step linear regression approach.

Computations are fast, even with a large number of pricing factors. The object

carries all the relevant variables as atributes:

- The yield curve itself

- The excess returns from the synthetic zero coupon bonds

- The principal components of the curve used as princing factors

- Risk premium parameter estimates

- Yields fitted by the model

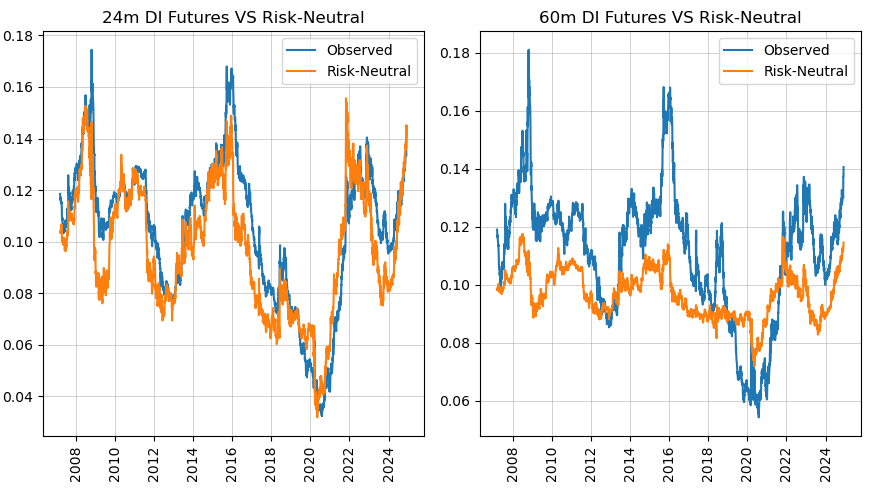

- Risk-neutral yields

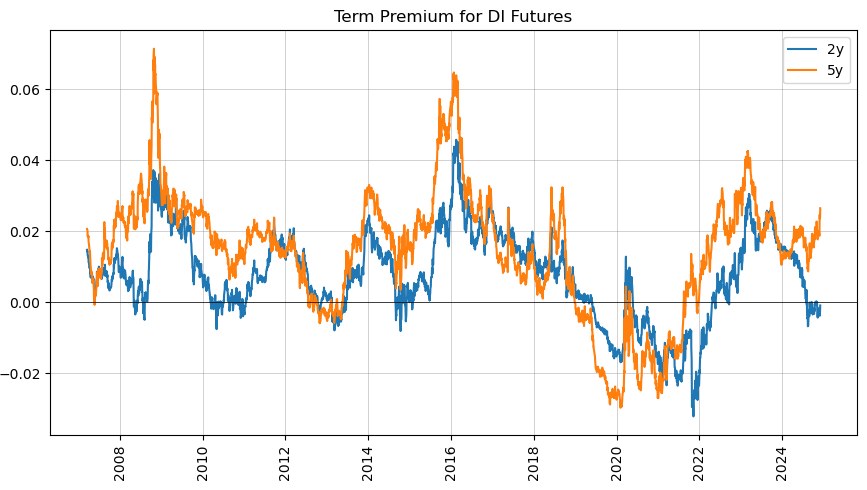

- Term premium

- Historical in-sample expected returns

- Expected return loadings

pip install pyacmfrom pyacm import NominalACM

acm = NominalACM(

curve=yield_curve,

n_factors=5,

)The tricky part of using this model is getting the correct data format. The

yield_curve dataframe in the expression above requires:

- Annualized log-yields for zero-coupon bonds

- Observations (index) must be in either monthly or daily frequency

- Maturities (columns) must be equally spaced in monthly frequency and start at month 1. This means that you need to construct a bootstraped curve for every date and interpolate it at fixed monthly maturities

The estimates for the US are available on the NY FED website.

The jupyter notebook example_br

contains an example application to the Brazilian DI futures curve that showcases all the available methods.

Adrian, Tobias and Crump, Richard K. and Moench, Emanuel, Pricing the Term Structure with Linear Regressions (April 11, 2013). FRB of New York Staff Report No. 340, Available at SSRN: https://ssrn.com/abstract=1362586 or http://dx.doi.org/10.2139/ssrn.1362586

I would like to thank Emanuel Moench for sharing his original MATLAB code in order to perfectly replicate these results.